We are often asked about what we do for health insurance, since Shawn and I are both self-employed. For many small businesses, freelancers and self-employed people, traditional health insurance is very expensive and typically very complicated in terms of what is covered. We have continued to check rates on private insurance over the years, and it is much more expensive than Samaritan, especially now that we have a family of 5.

The reason I put "insurance” in quotes above is because Samaritan is not technically health insurance. It is perfectly legal, though!

Samaritan Ministries is essentially a very organized response to Galatians 6:2: “Bear one another’s burdens, and so fulfill the laws of Christ”.

Samaritan is a large group of like-minded believers who share their medical bills and essentially pool their money so that they can alleviate other’s medical bills, and then in turn, have their own covered when it is time. It’s truly a beautiful, Biblical way to handle a major burden, and our family has been blessed by this ministry over and over.

I’ve written about this subject several times on my blog before, but it is time for an update. We have been members of Samaritan Ministries since 2012, and have had a baby and several larger medical procedures since.

A few things you need to know about Samaritan:

It is not technically insurance, but it is perfectly legal

You do have to sign a yearly commitment to attending church and living a moderate lifestyle.

It is NEED-based, meaning it is intended for use with individual medical needs, not chronic conditions.

Rates for families of 3 or more do not increase with additional children (yay!)

You’ll likely be paying out of pocket for any needs under 300.00 (well checks, etc.), so you will need a small savings account for those purposes.

Some medications are not covered (birth control being one), and some medications will not be covered after 120 days

Dental/Vision is not included

You can do everything online- it is so easy!

You can view current rates here: https://samaritanministries.org/membership-levels

Our family currently does Samaritan Classic, and we do opt-in to the Save to Share program, which allows us to submit needs over 250,000.00.

Samaritan is FOR YOU if:

You aren’t finished having babies. Samaritan has GREAT coverage for pregnancy and childbirth- everything was covered for us when Liv was born. One caveat, though, is that they will consider pregnancy a pre-existing condition if you sign up while pregnant. So, if you’re thinking about having children, go ahead and sign up before you get pregnant. :)

You have more than 2 kids. We love that the rates stay the same for families of 5+.

You aren’t generally sick, or only go to the doctor a few times a year. Being with Samaritan has changed my approach to healthcare, and I have started incorporating some more homeopathic remedies into our lifestyle before rushing to the doctor. I have learned how to treat a fever or ear infection at home without needing to go to the doctor (of course, I take my kids if/when it gets bad enough!), and I feel more in control of our options, and our health. It’s been empowering, honestly- to know I can take care of my kids. That being said, it’s been wonderful to know we can go to the doctor if we need to, and it’s covered. We don’t worry about the cost any longer.

You are self-employed, work at a church, or looking for an alternative to the crazy that is healthcare in our world right not

You can handle paperwork (it’s not that difficult, it’s just different). Being “self-pay” puts you in a whole other category as far as health care providers go. We have been shocked to find that the self-pay rate at many providers is 40-90% less than the insured rate. YES! We have actually received a 90% discount on a surgical procedure before, just because we are “self-pay”. Guys, if that doesn’t reveal that they system is broken, I don’t know what does. This does mean, however, that in many ways you will need to be in charge of the paperwork. Samaritan will ask you to submit your bills for every need, which means you have to obtain and keep up with the paperwork (this is clearly a struggle for me, haha- but I have learned and thankfully Shawn handles this most of the time!).

Major Benefits:

No limits on network. You can go to ANY doctor you choose. I think this is so freeing and I love that I have the ability to research and take my kids to the best doctor for their needs and not worry about being in-network.

Low cost. Compared to all of the other options out there, Samaritan’s monthly costs are low. Much of this is because of:

The Karis Group. This is an advocacy group that Samaritan utilizes to lower medical bills for their members. Yes, that is right! More than once we have benefitted from the Karis group. Recently, Shawn had an emergency appendectomy and the bill totaled over 17,000.00. We sent our bills in to Samaritan, who then sent them to the Karis group, who researched and negotiated that amount FOR US down to just over 5,000.00- all of which will be covered for us by Samaritan members. Friends, I don’t know how much better it can get than that.

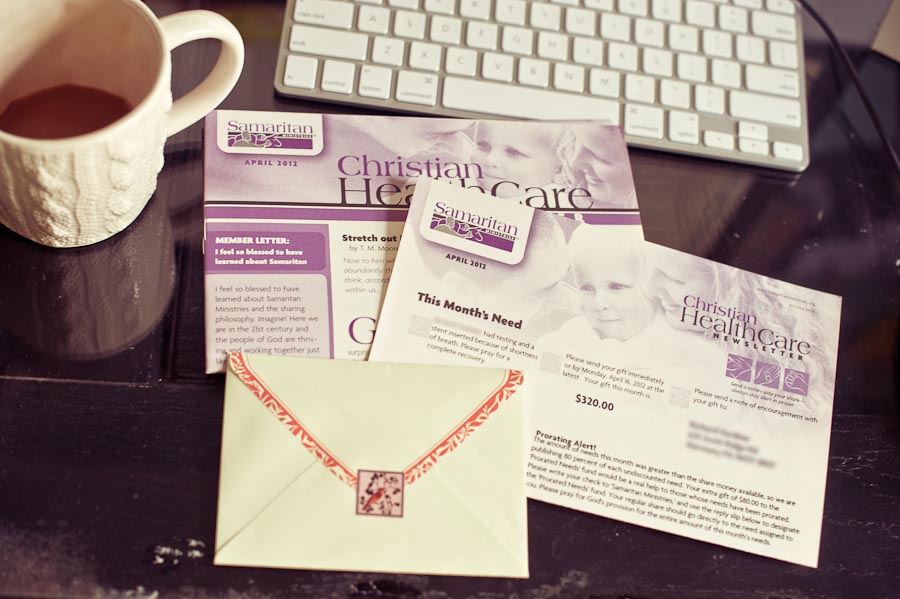

Prayer and notes of encouragement. Samaritan encourages their members to pray over the needs they receive each month. This means that we receive an actual person’s name and medical need each month, and pay our share directly to that person. It is really a cool process to be a part of- both on the giving and receiving side. We have been prayed for and had the honor of praying for others in their time of need. I will never forget the time a Samaritan member sent me an incredibly kind note and Christmas ornament after we submitted some bills from a miscarriage. It was such a powerful picture of the body of Christ holding each other up.

Other perks- like getting to vote on the board of directors and share increases (when was the last time your insurance company asked you for your input on its leadership?), and the Special Needs Adoption Fund (of course we love this!).

Occasionally our monthly rate is lowered because there were overall a lower amount of needs. Isn’t that awesome?! We never pay more than we need to.

GREAT customer service. I will never forget being brought to tears when I was trying to deal with our insurance company after having our son, Knox. I was pushed around to several different people, didn’t understand the terminology, and felt helpless. I don’t ever hesitate to call Samaritan, because I am always able to speak with a helpful person, who usually ends up praying with me before we get off the phone (not kidding- it’s awesome!).

Discounts of prescriptions. Samaritan has a prescription discount card we have found very helpful. I have also learned to ask for generic prescriptions from our doctors or remind them that we are self-pay, so they usually give us a less expensive option (sometimes even free samples so we avoid having to get the prescription at all!)

Unfortunately, part of the reason Samaritan works so well for its members is because it has some restrictions in place to keep costs down and the community of one heart and mind.

Samaritan is NOT FOR you if:

Do not attend church, uncomfortable with asking a pastor to sign your need form (required to submit your bills)

Smoke

Have pre-existing conditions (yes, this includes pregnancies that begin before you are a member). Sidenote: we did learn that some pre-existing conditions can be considered “healed” or no longer an issue with a doctor’s note saying that the symptoms no longer exist or you haven’t had issues for a long period of time.

Need monthly medication covered. This partially falls under pre-existing conditions, and the fact that they typically only cover medications up to 120 days after prescribed.

I hope this has been helpful! Feel free to comment with any questions you may have, or give Samaritan a call.

We will get a referral discount on our monthly share with Samaritan if you put my name (Lissa Anglin) in the referral space when you sign up. We are big fans of Samaritan and I’d be sharing regardless, but I so appreciate it if you include my name.